We have all heard frustrating stories regarding the exorbitant price of residential real estate in the U.S. and people who have been precluded from buying so far. The causes are multiple – interest rates are too high and inventory is too low, forcing people to bid over the asking price. So for a new buyer, the task of finding a house seems near impossible. But before we get too glum and throw this residential real estate problem onto the heap of other problems confronting the world today and adding to the American consumer’s lack of confidence, let’s look at the other side of this real estate coin.

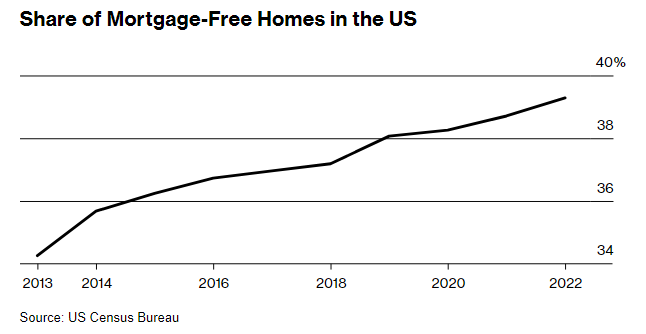

It might surprise many to understand that just about 40% of all U.S. homes are owned mortgage- free. For most Americans, their home is the largest single asset they own and so to own it without any debt attached to it is a very big deal.

CHART 1

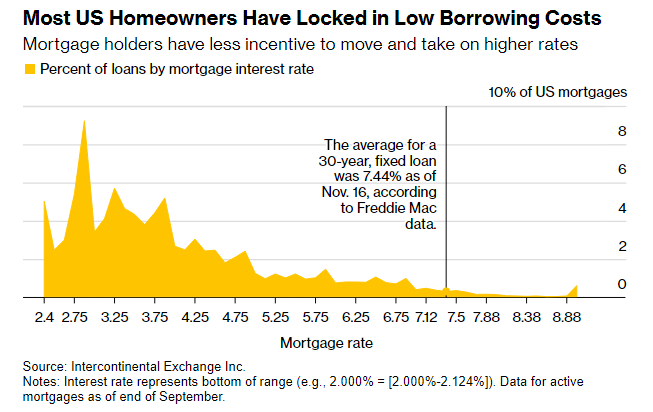

With no mortgage interest to pay or principal to pay down, a typical American homeowner’s expenses drop dramatically and their cash flow rises sharply, allowing them to live a much more comfortable life. Further, while there is this rather large group of people who own their homes debt-free, there is also quite a good-sized group who took advantage of the recent historically low mortgage interest rate environment and financed new purchases of residential real estate or re-financed earlier mortgages. While not free, this is historically “cheap” money.

CHART 2

Adding together those homeowners who are free of mortgage debt and those who pay say 3.25% as an interest rate, it would appear that more than 50% of American households are carrying their largest asset for little to no cost, according to the US Census Bureau. Further, for the first time in quite a few years, the majority of homeowners can now invest their excess cash flow in a safe money market fund paying 5% – earning a real return on capital.

Becoming debt-free is a long journey for most people and when achieved, it feels like a time when a great weight has been removed from one’s shoulders. Residential real estate has always been “expensive” it seems – because people have wanted to own, not rent forever. In this cycle, many are already debt-free and quite a few more borrowed very cheaply. While some “wannabe” homeowners are frustrated, many more are quite satisfied with their position. So frustration may well be discouraging – but it perhaps should not rank as a problem dampening consumer confidence.