These quotes from a leading publication give a good picture of the problem…

Bubble trouble – the current bubble still has a ways to go.

One of the investment services to which Baldwin subscribes – Strategas – notes the unusual “co-stars” of what many are considering a bubble in the financial markets. But sharing the spotlight in March were gold and other metals, and Bitcoin. Usually, stocks and gold move in opposite directions.

As Strategas points out, during the deflation of the 1930’s, owning bonds and gold was a good strategy: bonds for safety and gold as a safe store of value in scary times. Stocks were laggards in that deflationary environment.

Amid the inflation of the 1970’s, gold again worked as an inflation hedge, and specific stocks like energy and real estate rallied, but bonds underperformed in that environment.

In the “productivity-driven 1990’s”, a Goldilocks investor would own stocks and bonds, but there was no reason to own gold. The insurance provided by gold was unnecessary in that market.

The price of gold is now up, as are stocks. Something has to give, and we suspect it might be a tough environment for both stocks and bonds. Look at the charts of both gold and copper, which are always viewed as the ultimate leading indicators for inflation.

With gold rallying now, any window for ‘goldilocks’ is likely short-lived.

Stocks were up 10% in 2024’s 1st Quarter:

Gold price spiked by 10% this spring:

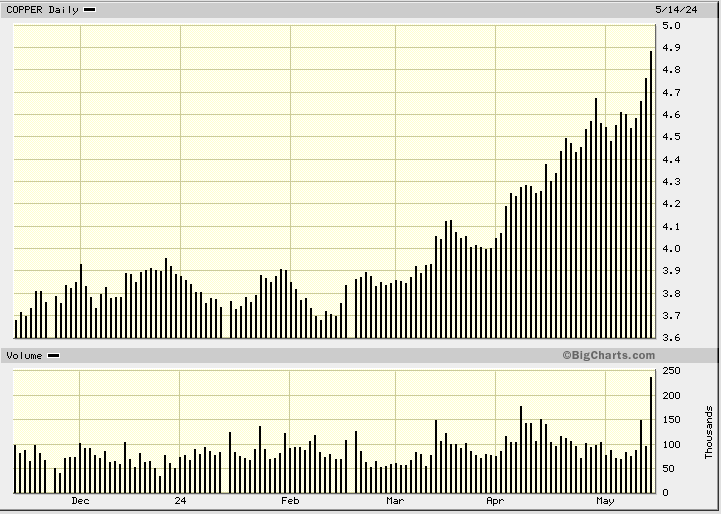

Copper prices surged 10% at the end of March:

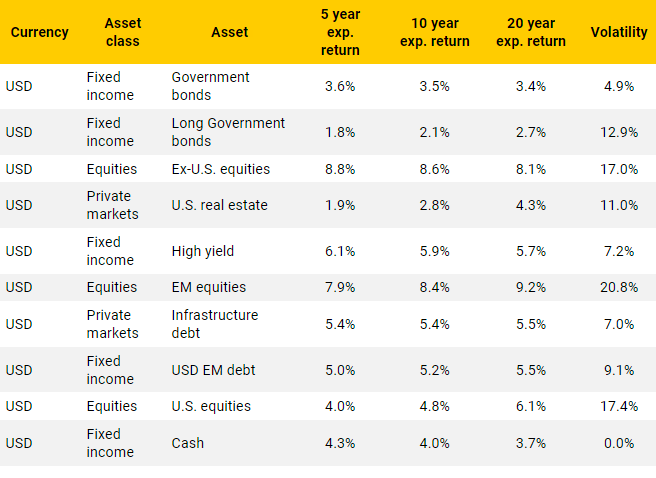

Blackrock Investment Institute projections by asset class as of March 2024:

In summary:

ExUS Equities: 8.6%-8.8%

US Equities: 4.0-4.8%

Cash: 4.0-4.3%

Tactical Considerations

For most investment professionals, the conventional wisdom is that politics is a side-show, unrelated to the economy or the stock market. That after this election cycle, like most before it, we will just return to business as usual. This conventional wisdom would suggest that investors can continue to watch the business coverage on CNBC and disregard the “talking heads” on Fox, CNN and MSNBC.

However, every once in a long while, elections have consequences, and this election year may be as consequential as those of 1932 and 1980. In 1932, Americans elected Franklin Delano Roosevelt as President, recasting the government as an active agent in the economy, not an undistinguished bystander. The role of the United States government changed in 1932 with the arrival of FDR.

In 1980, US voters selected Ronald Reagan to take our country in a different direction. He rode to victory ridiculing the phrase “I’m from the government, and I’m here to help.” Reagan rolled back the role of an activist government toward its historic bystander role, proposing to keep it out of the way of the capitalist model that was thought to work so well. This ‘new model’ then proceeded to work even better than Reagan had hoped in every way except for a more equal distribution of income.

In 2024, we have a “rematch” between incumbent Joe Biden and previous President Donald Trump.

There are four possible outcomes this November:

- Biden is reelected and carries the Democrats to victory in Congress, allowing the Democratic President and Congress to take the country in a new direction. This may be a threat to the present capitalist model of a “no holds barred” type of free enterprise.

- Biden is reelected, but Republicans have a Congressional majority serving as an effective block to prevent major legislative changes by the Biden administration, effectively continuing what’s going on now.

- Trump is elected and has a sufficient Congressional majority to get his policies passed. There’s a possibility that a collaborative Republican Congress might moderate the more controversial parts of Trump’s agenda.

- Trump is elected but the Democrats have a sufficient majority to oppose Trump’s policies. Unlike the scenario where Biden is constrained by a Republican Congress, this result might prompt more confrontation and uncertainty.

It’s The Congress

Right now, the election is a toss-up, and the media will be watching the headline presidential election race. We will be watching the Congressional elections much more closely.

Washington experts at Schwab have speculated on the outlook for the election in 2024, hearing from investors that they are worried about the results. Their studies of market reactions to past elections show little preference for either party, and performance immediately following elections has been the same regardless of which party won. Schwab points out, rightly in our view, that “the battle for control of the Senate and the House are more important”.

Over the decades, the political make-up of Congress has been a better predictor of how the markets will perform. We are watching these elections closely.

Baldwin Management LLC. (“Baldwin”) is a registered investment adviser that does not suggest a certain level of skill or training. The views and opinions expressed in this newsletter are those of Baldwin professionals and may change at any time without prior notification. There is no guarantee that the objectives of any investment program will be achieved. Any strategies or securities discussed is not a recommendation to invest in such strategies or to purchase or sell securities. Investing involves the risk of partial or total loss that investors should be prepared to bear. Past performance is not a guarantee of future results.. The value of investments may be worth more or less than their original cost when sold. Baldwin obtains information from third-party vendors believed to be reliable; however, the accuracy of such information is not guaranteed. For additional information regarding Baldwin’s business practices, registration status and important disclosures, please click on the following link and type our name in the space provided IAPD – Investment Adviser Public Disclosure – Homepage (sec.gov)

Richard K. May, Managing Director of RKM – A Baldwin Company

Richard founded his financial advisory firm in 1980, which was one of the early fee-only advisors in the industry. He received his B.A. from Princeton University and his M.B.A. from the University of Michigan.

In 2007, Richard founded the West Chester LLC, a private equity company that promoted and funded business start-ups and public projects in the Borough of West Chester. In 2011, he co-founded the Uptown! Entertainment Alliance and the Uptown! Bravo Theatre, LLC. Together they purchased and rehabilitated the National Guard Armory, and then opened the Uptown! Knauer Performing Arts Center in 2016. Richard also serves on the board of Chester County OIC and is currently working on starting a live performance venue in Kennett Square, PA for 2023.