Inflation is again becoming a topic of conversation in the markets – especially the bond market. Already bond yields have risen some 40 basis points (BPS) on the 10-year Treasury since year end 2020. Those yields have gone up and bond prices down simply because investors fear that broad based inflation is “around the corner”, not that it is present right now. So just the anticipation of inflation “being in the wind” is enough currently to pressure the U.S. bond market and have spillover effects on the stock market.

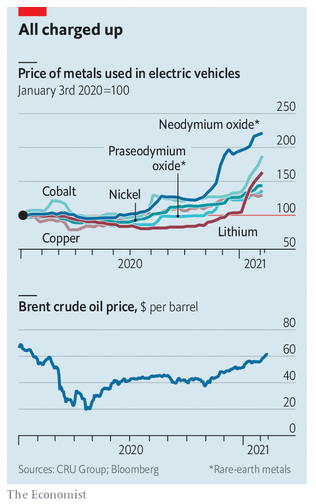

Interestingly in some metals and the oil markets, there is inflation – but for very different and seemingly contradictory reasons. Very different because the metals prices are rising due to demand pull and energy due to supply push. Contradictory because these materials are in competition with one another.