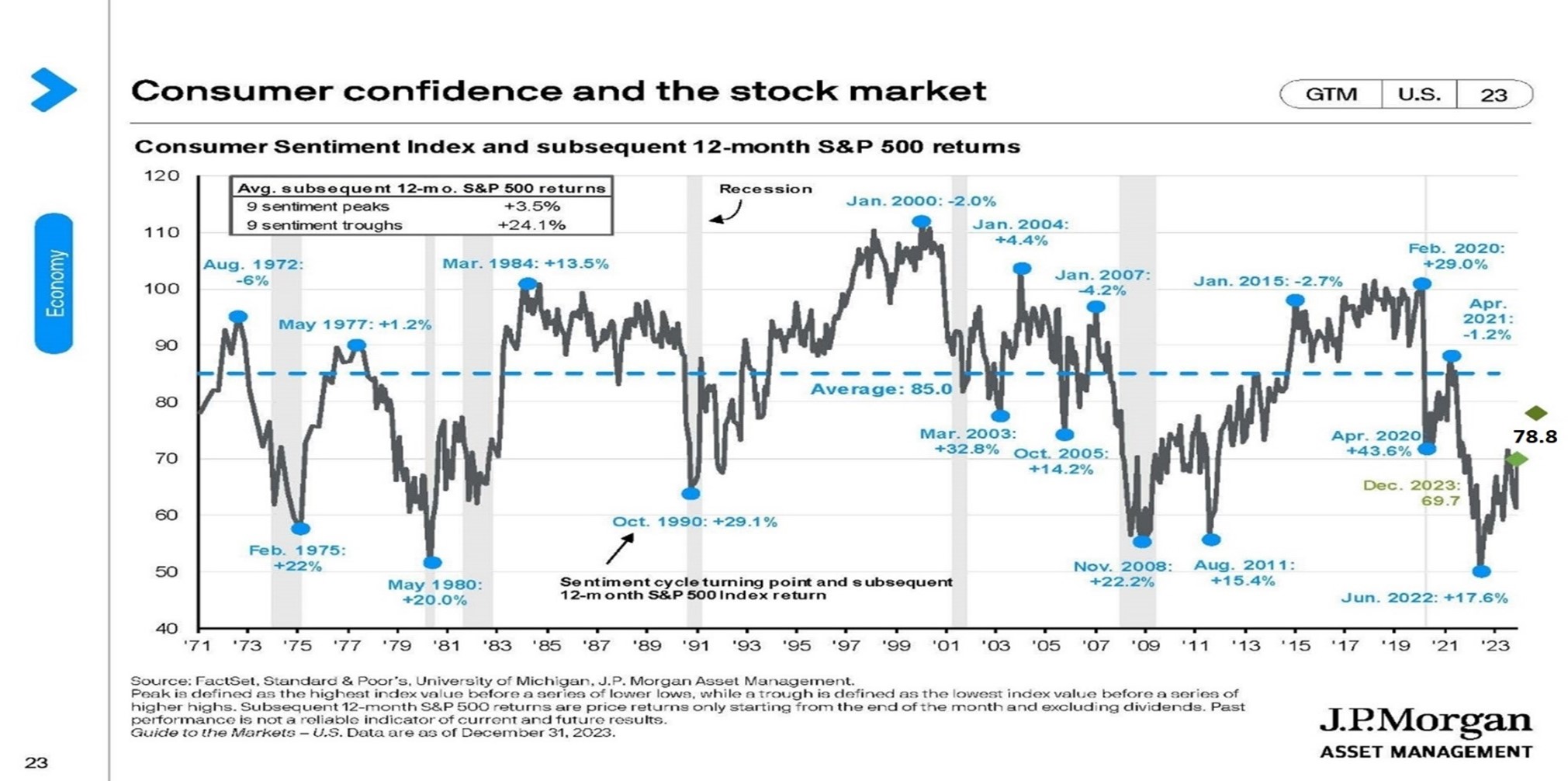

For some time, economic indicators have been telegraphing that the U.S. economy was improving. But American consumers did not seem to care – at least as reflected by consumer surveys. They just seemed to frown, with sentiment scores well below the average of 85. But conditions describing the U.S. economy and the American consumer’s financial health have been far more positive than the gloom U.S. consumers were reflecting in sentiment surveys. Unemployment is down to historical lows. Inflation, recently in excess of 9% by certain measures, has dropped sharply to 3% year over year and to around 2% over the past 6 months. Interest rates for consumers, mortgages and for businesses, which ran up earlier in 2023, look to have topped out according to the Fed’s dot plots. Fears of a recession, predicted by quite a few in 2022 and 2023, are receding. Gasoline prices are off their highs. Food prices are beginning to crack as major grocery chains advertise commitments to help families now that supply chains are running more smoothly than they were. Service prices also look like they are about to finally soften as residential rental rates (a big component of most service inflation measures) are down substantially. All the aforementioned facts had not seemed to move sentiment much. However, the American consumer has finally taken note of the good news regarding low unemployment, receding inflation, anticipated lower interest rates, higher real wages, etc., as evidenced by the most recent University of Michigan Consumer Sentiment Index. The index jumped to 78.8 in January from 69.7 in December (+13%), to the highest level since July 2021. This surge, with the index up some 29% since November 2023, is the biggest two month increase since 1991 and should mean good things for the American economy and U.S. stock markets. Following is a chart that readers of ours will recognize as we have used it in the past:

CHART 1

In past commentaries, we have noted that when consumer confidence retreats to a score of between 50 and 60, this has historically coincided with a bottom in the S&P 500, with the potential for significant stock market gains averaging 24.1% subsequently. As can be seen in the above chart, the University of Michigan Consumer Sentiment Index bottomed in June of 2022 at about 50. In December of 2023, the index was 69.7 and in January of 2024, the index rose to 78.8. Since June 2022, the S&P 500 has appreciated by 30%. With such an improvement in consumer sentiment, the outlook for the American economy should be rather strong, as the American consumer drives approximately 70% of U.S. economic growth. Solid economic growth and diminishing concerns about a recession should invigorate consumption, driving corporate sales, cash flows and earnings. Stock prices should be well supported and the consumers’ frowns should hopefully remain upside down.

The opinions expressed in this Commentary are those of Baldwin Investment Management, LLC. These views are subject to change at any time based on market and other conditions, and no forecasts can be guaranteed. The reported numbers enclosed are derived from sources believed to be reliable. However, we cannot guarantee their accuracy. Past performance does not guarantee future results.

We recommend that you compare our statement with the statement that you receive from your custodian. A list of our Proxy voting procedures is available upon request. A current copy of our ADV Part II & Privacy Policy is available upon request or at www.baldwinmgt.com/disclosures.